Mortgage approvals in the Canary Islands went up by 43% in January

- 24-03-2025

- National

- Canarian Weekly

- Photo Credit: Freepik / epdata.es

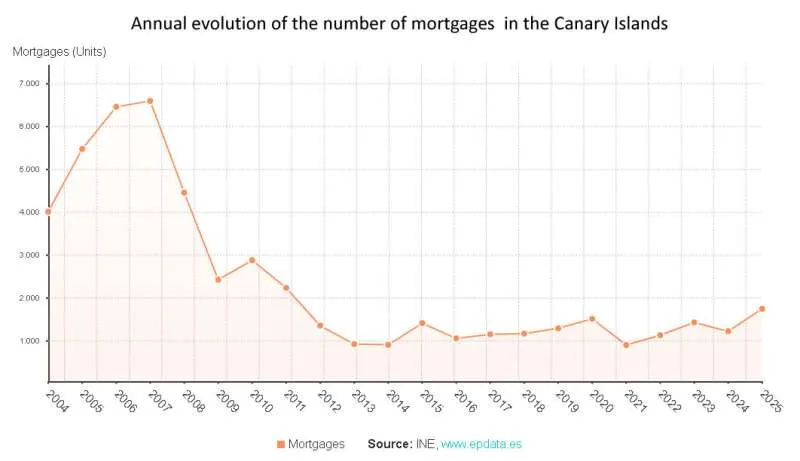

The Canary Islands saw a dramatic year-on-year increase of 43.3% in the number of mortgages approved for residential properties in January, according to data published by the National Statistics Institute (INE).

This surge, significantly higher than the national average of 11.03%, marks the fifth consecutive month of annual increases in the region.

A total of 1,741 mortgages were signed for homes in the archipelago during January, with loans amounting to €223.08 million, which is a 57.8% increase compared to the same month in 2024. Compared to December, the number of residential mortgages rose by 81.4%, while the capital loaned jumped by 83.3%.

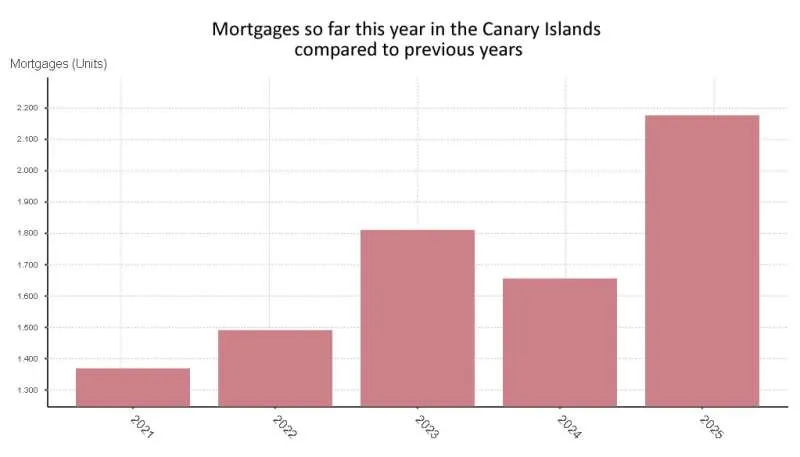

When considering all types of property, 2,176 mortgages were formalised in the Canary Islands in January, involving a total capital investment of €396.22 million. Of these, 43 were for rural properties and 2,133 for urban ones.

Breaking down the urban property category, 1,741 mortgages were for residential homes, 11 for land plots, and 381 for other types of urban/commercial property.

In terms of mortgage modifications, 411 agreements saw changes to their conditions. The majority of these (339) were novations, which are changes agreed between the original lender and borrower. Additionally, 25 mortgages were transferred to a new lending entity (creditor subrogations), and 47 involved a change in the borrower (debtor subrogations).

Despite the rise in new agreements, a total of 3,720 mortgages were cancelled across the Canary Islands during the same period. Of these, 3,059 were on homes, 37 on rural properties, 592 on other urban buildings, and 32 on land plots.

Across Spain, mortgage activity increased in all autonomous communities except Madrid and Galicia, which recorded year-on-year declines of 29.11% and 2.31% respectively. The most significant growth was seen in La Rioja (+65.88%), followed by the Canary Islands and Aragón (+41.32%).

As for the amount of capital lent, increases were recorded in all regions. La Rioja led the way with an 82.51% rise, followed by Murcia (+75.70%) and the Balearic Islands (+63.42%). By contrast, Galicia and Madrid saw more modest growth of just 4.81%, while Navarra registered an increase of 8.88%.

Other articles that may interest you...

Trending

Most Read Articles

Featured Videos

TributoFest: Michael Buble promo 14.02.2026

- 30-01-2026

TEAs 2025 Highlights

- 17-11-2025