The UK’s most wanted woman is arrested in Spain whilst walking her dogs

- 02-03-2022

- National

- Canarian Weekly

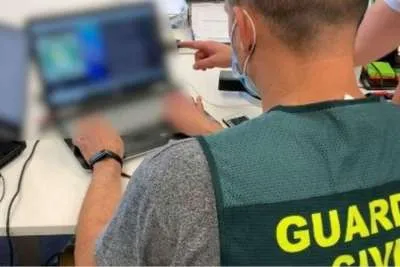

The Guardia Civil announced yesterday (Tuesday) that they have arrested the UK’s most wanted woman over an alleged £1billion VAT scam, following nine years on the run. The fugitive, who has been identified by the National Crime Agency (NCA) as 47-year-old Sarah Panitzke, was arrested on Sunday whilst walking her dogs in Santa Barbara, a small town of around 4,000 inhabitants in the province of Tarragona in Catalonia.

She has been on the wanted list since 2013 for alleged money laundering offences as part of a 16-strong criminal gang that bought mobile phones abroad without VAT, then resold them in the UK. The gang made profits of ‘more than a billion pounds’, the Guardia Civil and the NCA said in separate statements.

Panitzke is originally from York and vanished in May 2013 before being convicted and sentenced in absentia to eight years behind bars. She was the last of the gang to be caught, with other members collectively sentenced to 135 years in jail, the NCA said in a press release.

Investigators from the UK tax authorities said that Panitzke was responsible for laundering all of the group’s income through multiple companies in Spain, Andorra, and Dubai. The gang managed to shift more mobile phones in the UK than the collective number sold by all legal outlets, said the Guardia Civil, citing British investigators.

The NCA tweeted a warning to others about her arrest!

In 2015, police discovered she was living in Olivella, just south of Barcelona, with her husband bringing supplies at weekends. But she realised the police were onto her and ‘totally changed her appearance and fled’, later cutting all physical ties with her family to avoid detection.

It was seven years before they found her again after being tipped off she might be in Santa Barbara in February. After a lengthy surveillance operation, police spotted a woman ‘who clearly had the same physical characteristics’. This time, they deployed multiple agents in civilian clothing to ensure she wouldn’t escape again.

‘Sarah Panitzke was one of Britain’s most wanted tax fugitives. She played a pivotal role in a multi-million pound VAT fraud and moved millions through offshore bank accounts,’ said Simon York, head of HMRC’s fraud investigation service in a statement.

‘She thought she had put herself outside of the reach of HMRC, but … no tax criminal is beyond our reach.’

Other articles that may interest you...

Trending

Most Read Articles

Featured Videos

TributoFest: Michael Buble promo 14.02.2026

- 30-01-2026

TEAs 2025 Highlights

- 17-11-2025