The escalation of the Euribor accelerates requests to change mortgages

- 25-09-2022

- Business

- Canarian Weekly

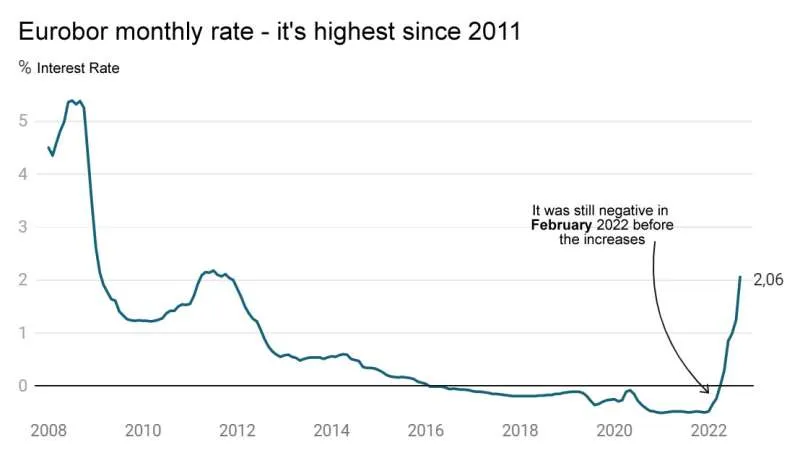

The rise in the Euribor has put millions of mortgage holders in check who face the highest increase in monthly payments in history. The indicator, to which the majority of mortgages in Spain are referenced, has already risen to a 2.5% daily rate, the highest since January 2009 and placing the provisional average for September at 2.13% , well above the 1.25% in August and a long way from the -0.5% which it was just a year ago, and in fact an average this high has not been seen since July 2011.

"The usual trickle of customers who come to enquire about how to change from a variable to a fixed mortgage has been constant since before the summer, but recently this has increased exponentially" acknowledges a representative from the banks.

“The staff of the banks do not have it easy at all, because they are told to advise clients to avoid a change, as the new mortgages that are sold are variable, making them more attractive than the fixed ones.”

A few months ago, there was an interest rate of 1% APR, or even lower in fixed rates. But now it is almost impossible to find something that falls below 2%, which has triggered this increase in requests to change mortgages.

So, is it worth changing your mortgage, and what can you do if your monthly payments spiral out of control?

Code of good practice:

The Minister of the Economy, Nadia Calviño, announced this week that her department is already working with the banks to help families who are struggling with the rise in the Euribor. The idea is not to establish a ceiling on mortgage interest as, Unidas Podemos proposes, nor to create a fund to help those affected, as the ERCo unions propose.

Instead, it would be a question of "strengthening" the Code of Good Banking Practices. Above all, because measures such as the cap on the variables would leave those who, at the time subscribed to fixed mortgages out of aid, paying more expensive interest in exchange for shielding themselves from a Euribor from which, on the other hand, the variables have benefited during years of negative rates.

What are the banks doing?

Apart from the negotiations with the Government, some banks have been applying their own measures for some time to deal with their clients in trouble. Banco Sabadell, for example, is reinforcing the Sogeviso service, the subsidiary with which it manages its vulnerable customers. Others are ensuring that they adhere to the measures established by law and the Code of Good Practices to which they adhere.

Your rights as a client:

This Code establishes a series of rights for clients who cannot meet their mortgage payments:

- The bank cannot charge interest on arrears higher than the ordinary rate plus 2% on the outstanding capital.

- The bank has a month to prepare a debt restructuring plan with new conditions. Of course, they can also deny the request, in the event that the applicant is not in the exclusion threshold, or if he is already immersed in an execution procedure.

- The modifications must include, at least, a lack of capital of five years, an interest rate of Euribor plus 0.25% during that period, and an extension of the mortgage term to 40 years. It may happen that, despite these measures, the monthly fee to be paid exceeds 50% of the income of the family unit. In that case, the restructuring plan is considered unfeasible.

- If that happens, the client would have the right to ‘dation in payment’ (when the bank cancels the debt completely in exchange for the property), but this should be the last option. As explained by Laura Martínez, spokesperson for iAhorro, the client can try to improve the conditions with their bank (novation), change banks through a subrogation, or the last option, and the most expensive, is the cancellation of the mortgage.

Subrogation or novation:

According to experts, subrogation is only interesting in the first period of life of the mortgage when more interest is paid. “If there is around 10 years left on the loan, surely we are not interested in changing banks,” they say.

In addition, this type of operation also has a cost that, according to Martínez, can be between 1,000 and 2,000 euros, depending on the amount of the mortgage and whether there is a penalty clause for making the change.

In return, the change of bank usually presents greater facilities than in the novation to eliminate another series of expenses, such as life or home insurance linked to the loan.

Costs of changing from variable to fixed:

Since 2019, the Real Estate Credit Law establishes that if a novation or subrogation of a variable mortgage is carried out to a fixed one, the maximum commission must be 0.15% (on the amount pending payment) if the loan is less than three years old.

If the mortgage was signed longer ago than that, no commission will be charged, so these terms must also be taken into account when making the operation cheaper.

It all depends on the term:

The client must also take into account that not all variable mortgages will be affected equally by the current rise in the Euribor, since everything will depend on the year in which it was contracted. Yes, it is in the first ones when more interest is paid and, as the years go by, the principal takes on a greater weight, until at the end of the loan only this part is practically paid.

Therefore taking a mortgage of 150,000 euros at Euribor interest plus 1.5% and a term of 25 years as a reference (assuming that no early repayments have been made), the experts at the Idealista.com portal calculate that, for someone who contracted a variable mortgage in August 2021, the increase in the monthly fee to be paid will be 118 euros (1,421 euros per year). This figure is reduced to 104 euros per month (1,245 euros per year) in the case of signing one in 2018, and only 44 euros per month (528 per year) in the event that it had been signed in 2005.