What Should New Investors Know About Risk Management Tools?

- 06-08-2025

- Business

- collaborative post

- Photo Credit: Unsplash

Risk management in investing constitutes the organised approach of recognising, evaluating, and limiting potential losses across an investment portfolio. For beginning investors exploring unknown areas like property markets or global stocks, grasping this principle becomes the basis on which lasting wealth creation depends.

Modern financial markets offer intricate challenges where risk management instruments are crucial to any legitimate investment approach. Here are what new investors should know about risk management tools.

Stop-Loss Orders

Stop-loss orders are automatic protective mechanisms that trigger sell orders when securities hit preset price thresholds. These instruments avoid emotional choices during market declines by setting definite exit points before positions turn unfavourable to investors.

Expert traders usually place stop-losses at 5-10% below buying prices for individual stocks, although this rate changes according to asset fluctuation and investment periods.

The success of stop-loss orders relies significantly on market circumstances. During regular trading sessions, these orders offer dependable protection. Nevertheless, in unstable markets or during price gaps at opening, stop-losses may trigger at prices considerably beneath activation levels, a situation called slippage. Recognising these constraints enables investors to use stop losses more tactically.

Hedging Strategies for Portfolio Protection

Hedging means establishing counterbalancing positions to minimise portfolio exposure. Standard hedging methods include buying put options on significant positions, selling short related securities, or purchasing assets that generally excel during market downturns. For example, investors who trade S&P 500 CFD positions could hedge by acquiring put options on the identical index or buying volatility-focused instruments.

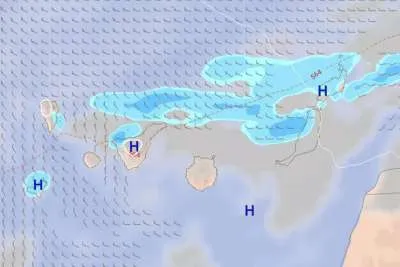

Foreign exchange hedging becomes crucial for global investments. Currency rate changes can substantially affect profits from international positions, occasionally outweighing the fundamental asset returns. Exchange rate-protected ETFs and forward agreements help reduce these exposures.

Diversification Beyond Geographic Boundaries

Diversification across asset categories and geographical areas continues to be one of the most basic risk management approaches. This method includes distributing investments among stocks, bonds, commodities, real estate, and alternative assets, decreasing portfolio exposure to any individual market sector. Geographic diversification applies this concept globally, safeguarding against nation-specific economic recessions or currency variations.

Successful diversification demands comprehension of the correlation relationships between various assets. During financial emergencies, previously unrelated assets frequently move together, diminishing diversification advantages exactly when required. Advanced investors consequently look for assets with minimal or inverse correlations throughout different market situations, not merely during typical times.

Index-Tracking Instruments and Market Exposure

Exchange-traded funds and index funds offer convenient diversification solutions for beginning investors. These vehicles follow comprehensive market indexes, providing immediate access to hundreds or thousands of securities via individual transactions. Apart from ease, index-following cars generally have lower fees than actively managed funds, enabling greater investment returns to grow over time.

Expanding specialised ETFs permits focused exposure to particular sectors, areas, or investment concepts while preserving diversification within those segments. International ETFs enable investors to engage in foreign markets without the complications of direct international investing, including currency exchange and foreign brokerage connections.

Global Market Interconnectedness

Changes in major US indices like the US500 generate cascading effects across global markets, especially affecting emerging market investments. When US markets fall, international capital frequently moves toward perceived safe assets, decreasing liquidity in emerging markets and increasing volatility. Recognising these connections assists investors in predicting potential portfolio effects and modifying positions preventively.

Live monitoring systems for major benchmarks like the US500 allow investors to observe these relationships and react to evolving market conditions. Contemporary platforms offer advanced analytics displaying correlation trends and past relationships between various markets.

Building a Proactive Risk Management Framework

Effective risk management demands systematic execution rather than reactive responses to market events. This involves;

- Creating clear position sizing guidelines

- Consistently rebalancing portfolios

- Upholding predetermined strategy modification standards

Disciplined commitment to these frameworks frequently determines investment results during economic instability or market declines.

Technology has made institutional-grade risk management tools accessible to everyone. Individual investors now possess access to live portfolio analytics, stress testing features, and automated rebalancing services that were formerly available exclusively to large institutions.

Endnote

The investment environment keeps changing, but the core significance of risk management stays unchanged. Beginning investors who learn these techniques and integrate them methodically into their investment procedures set themselves up for sustained success despite market circumstances. Risk management isn't about preventing all losses but managing them adequately to enable compound growth to function over time.

Other articles that may interest you...

Trending

Most Read Articles

Featured Videos

TributoFest: Michael Buble promo 14.02.2026

- 30-01-2026

TEAs 2025 Highlights

- 17-11-2025