More Searches, Fewer Bookings: The Canary Islands face a tourism paradox this August

- 06-08-2025

- Business

- Canarian Weekly

- Photo Credit: C7

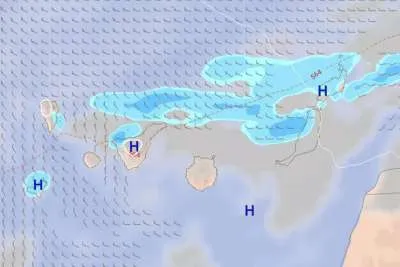

The Canary Islands are at the centre of a surprising tourism paradox this August: online interest is booming, but actual hotel bookings are falling. Despite leading European travel searches, the archipelago is seeing a notable decline in confirmed reservations compared to the same period last year.

Record Searches, Disappointing Bookings

According to recent figures from travel search engine Jetcost, flight searches for the Canary Islands are up 8%, and hotel searches have risen 9% compared to August 2024. Tenerife and Gran Canaria top the charts as preferred destinations, followed closely by Fuerteventura and Lanzarote.

However, data from the hospitality platform Dingus reveals a different story on the ground. As of early August, only 193,100 bookings have been recorded for the month, down 11.9% from last year. The number of hotel nights planned, totalling 1,290,589, is 14.54% lower than in August 2024.

This mismatch between digital demand and actual bookings is raising concerns within the tourism sector, as it highlights a growing gap between traveller interest and spending commitment.

Who’s Still Booking—and Where?

Couples continue to make up the majority of travellers, accounting for 60.7% of all bookings. Most visitors are opting for stays between three and seven nights (64.9%), while longer holidays of eight to fourteen days make up 21.4%.

The all-inclusive model remains the most popular choice, representing 44% of bookings, followed by half-board (23%) and bed and breakfast options (17%).

Top resort areas are seeing the bulk of demand. In Gran Canaria, Maspalomas, Playa del Inglés, and Meloneras lead the way. In Tenerife, it’s Costa Adeje and Puerto de la Cruz. Playa Blanca remains Lanzarote’s standout destination.

Bookings by Channel

Tour operators still dominate the booking landscape, accounting for 36.1% of sales. Online travel agencies (OTAs) make up 30%, and direct bookings represent 15.4%. Leading platforms include Booking.com, Jet2Holidays, TUI (UK and Germany divisions), and Airbnb

Why the Drop?

Industry experts point to several factors behind the booking decline:

- Rising travel costs and tourism inflation which may be discouraging last-minute commitments.

- Shifting travel trends, with many European tourists now favouring spring or autumn breaks over peak summer travel.

- Increased competition from other Mediterranean destinations such as Turkey, Greece, and Tunisia, which are offering more competitive pricing and packages.

While interest in the Canary Islands remains high, converting that attention into confirmed stays appears to be the key challenge for the sector this summer.

Other articles that may interest you...

Trending

Most Read Articles

Featured Videos

TributoFest: Michael Buble promo 14.02.2026

- 30-01-2026

TEAs 2025 Highlights

- 17-11-2025