Latest Euribor increase will add 3,100 euros a year to average mortgage repayments in Spain

- 22-01-2023

- Business

- Canarian Weekly

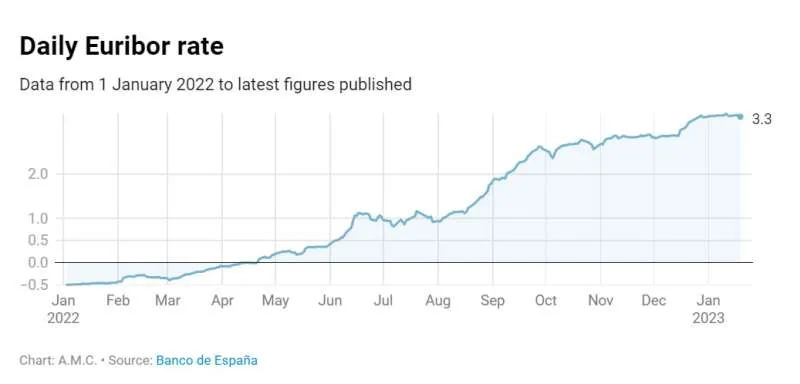

There is more bad news for people with mortgages, as things are not set to improve in the short term, in this case for those whose interest rate is governed by the Euribor. The rise in the rate is far from reaching its ceiling and variable rate loans will continue to become more expensive, at least during the first months of 2023.

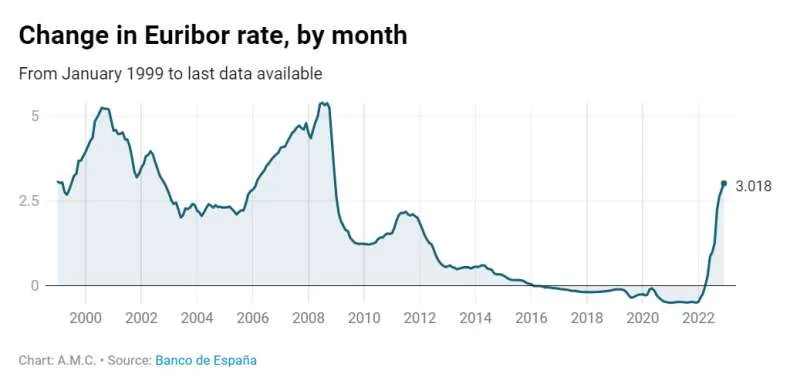

As feared, this indicator for the mortgage market ended last year above the psychological threshold of 3%: the average for the month of December was 3.018% compared with 2.828% in November. Over the last 12 months, the index has risen by 3.52 points.

This new increase will mean a sharp rise in monthly repayments of variable rate mortgages, which are reviewed this month taking the Euribor in December into account.

Borrowers with a 150,000 euro loan over 25 years and a differential of one point, will have to pay 260 euros more each month, which amounts to an extra 3,150 euros a year. For a 200,000 euro mortgage with the same conditions, the monthly payments will go up by 350 euros a month, meaning an increase of nearly 4,200 euros a year.

Market analysts believe it is highly probable that the Euribor will stay between 3.5% and 4% this year, however, it is difficult to predict where the mortgage rate will be at the end of the year because its value will depend on what happens to inflation, European Central Bank (ECB) policy, and also the war in Ukraine.

If the conflict in Ukraine is prolonged and inflation remains high in the months to come, the European Central Bank will be obliged to keep raising its rates because the Euribor will keep going up. On the other hand, if inflation drops, whether because the war ends soon or because recent interest rate rises have had an effect, the ECB could soften its policy and the Euribor could remain the same or lower.

A slowdown in mortgage applications:

The rise in the Euribor is already causing a slowdown in the mortgage market. In the final months of 2022, not as many mortgage contracts were signed as earlier in the year, and it is believed that this will continue. If the Euribor goes up, mortgages will be more expensive, and fewer people will be able to afford to buy a house so there will be fewer applications for mortgages.

Banks will also be more cautious, partly due to the economic instability and partly because of the higher cost of mortgage loans. They won't want to take risks so they will be more selective and it is probable that fewer applications will be approved.

As a result, 2023 is likely to see stagnation or even a reduction in the number of new mortgages compared with 2022. And if fewer loans are granted, it is logical that property sales will also fall, because practically half of all purchases are financed by a mortgage.

Default on payments:

Another logical consequence of higher mortgage repayments is an increase in the number of people who default on their loans, which is likely to happen because the Euribor will make repayments on variable rate mortgages much more expensive and there will be people who cannot pay the increase.

However, it is important to remember that almost 30% of mortgages are fixed-interest, so their holders will not be affected by the increase in the Euribor, and that many holders will be able to renegotiate the conditions of their mortgages to reduce their repayments, either through a direct agreement with the banks or via measures approved by the government.