More British tourists say they have been scammed by Tenerife’s ‘rogue traders’

- 16-04-2023

- Tenerife

- Canarian Weekly

'Sun, sea and SCAMMED!' That is the headline on MailOnline as more British tourists who have had credit cards cloned, or thousands taken from their bank accounts, have stepped forward following the article about Bridget Manning being scammed of £2,100 in Tenerife when buying a tablet from an electrical shop.

They are demanding a crackdown on the ‘rogue traders’ in Tenerife after being fleeced for thousands of pounds in a long-running scam that is 'tainting' the image and reputation of the island.

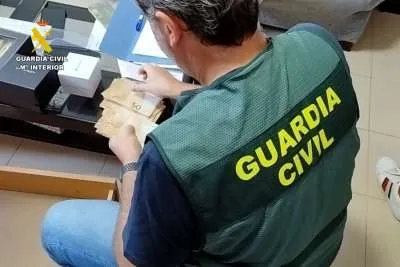

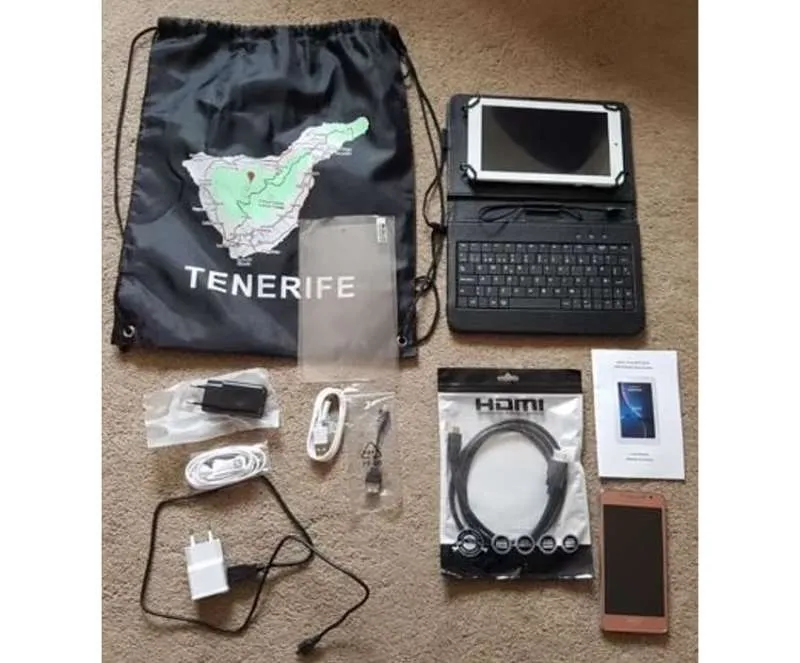

According to the victims, the scam typically works when the shop offers tourists a great deal on a laptop, tablet, phone or a similar device when they are on the last day of their holiday. However, when it comes to payment via debit or credit card, the store owners distract the buyers while they either clone their card or charge a far higher fee than agreed.

84-year-old Bridget Manning revealed earlier this week how she was secretly charged more than £2,000 for a tablet that was supposed to cost her just £150. Now Andy Evans from Doncaster has said how he lost £1,676 last year after buying what he thought was a £14.50 monthly television subscription (and his bank still refuses to refund him), Jane Harrison, from Bolton, has explained how her elderly parents were scammed for £2,800; and Mary Kinneen has contacted the Canarian Weekly saying she lost a staggering €5,000 after buying an ice cream in Los Cristianos.

Mr Evans was enjoying a drink at a bar with his wife in Los Cristianos when they decided to buy some t-shirts and souvenirs for their grandchildren. He told the MailOnline they went to the shop next door, where they were approached by the owner, who also happened to own the adjacent bar.

“He struck up a conversation and was asking us about property and tobacco and all of this before he eventually said he had tablets for sale at a great price.”

Mr Evans said he paid for the tablet with €50 cash before the store's 'software engineer' approached him and insisted it should be upgraded with a subscription package that would allow them to watch UK television while abroad. “It was only €14.50 per month and I could cancel it at any time so I thought nothing of it,” he added. But when he put in his PIN to pay for the amount, the shop owner said they were having 'internet problems'.

“He took the machine away and was waving it around as if he was trying to get it connected to the internet, and I think it was then that they cloned my card,” Mr Evans said. At this stage, the men then drove him to Puerto Colon in Costa Adeje where they own more shops, where he made a successful payment of €14.50.

However, when he returned to the UK and saw his account, there was an amount of £1.678.76 pending. He urgently called his bank (Halifax) to ask them to stop the payment, but was informed that they could not stop the payment as he was present at the time of the transaction and it would be word against word.

He concluded: “As you can imagine, I am still fuming about this and sorry to hear that this team is still at it. I believe the scammers use the bar adjacent to their store to scout for unsuspecting victims and to gauge who is on the last day of their holiday.”

Jane Harrison explained how her father and mother, now aged 85 and 90, were offered a tablet and a phone for less than a couple of hundred pounds, but were secretly charged a staggering £2,800. She says that an Asian business owner named 'Gary' told her it was 'all legal' when she phoned the shop to confront him upon seeing her parents' credit card bills.

She added: “I successfully got all their money back with an additional £200 as compensation from Nationwide. It took around five months but it was well worth it.”

“I also contacted the consumer advice department in Adeje and they were marvellous. They marched to the shop and made them pay back just short of £1,000 then we got the other £2,000 from the bank.

Mary Kinneen contacted us directly here at the Canarian Weekly after reading the article about Bridget, explaining how she was scammed of €5,000 after buying an ice cream from a shop on the Los Cristianos promenade.

After unsuccessfully trying to cancel the transaction, she took her case to the ombudsman in Ireland to claim back the money and has only received part of it. Mary told us: “I will never visit Tenerife again, and I will tell all my friends not to go there either.”

She also added that she has the name and a photograph of the shop that scammed her, but unfortunately, for legal reasons, we cannot publish it.

OTHER PEOPLE SCAMMED:

Harry Mathers, aged 66 from Salford, said he was also offered a tablet for £50 in September, before buying a 'better model' for £90. The store's 'engineer' told him he needed to set it up in English and that his debit card wasn’t working. He was asked if he had sufficient funds and said there was about £450 in his account. They took £453.16 which was everything he had in there.

Donal Byrne, aged 79 from Dublin, managed to avoid losing out to fraudsters after becoming immediately suspicious at checkout when they tried to distract him. He paid €150 for a laptop and was then offered an upgrade for €19.75, but the scammers tried to secretly charge him €1,975. He asked for the card receipt which they wouldn’t give, and fortunately he was able to cancel the transaction because the bank believed his story.

He said: “On the last day of my holiday in February 2022 I entered the shop and ended up purchasing, or so I thought, a computer at a very reasonable price. I was fortunate that this happened around midday and I had time to ring my credit card company and request they cancel the transaction. There was a certain reluctance to cancel and I was queried at length as to why I had willingly input my PIN. But they agreed to.”

“The old adage is so true - if it seems too good to be true it is too good to be true. My culprits were Indians and the exterior of the shop gave every indication that it was a typical summer clothing retail outlet, with no hint of computers for sale.”

Other articles that may interest you...

Trending

Most Read Articles

Featured Videos

TributoFest: Michael Buble promo 14.02.2026

- 30-01-2026

TEAs 2025 Highlights

- 17-11-2025